Peanut butter and jelly. Bread and butter. Night and day. Newton’s third law: for every action, there is an equal and opposite reaction. And of course, Frank Sinatra’s famous song “Love and Marriage” is like a horse and carriage! These are all themes of the classic phrase “You Can’t Have One Without The Other”. This concept also relates to the markets because put simply you have to pay the price of admission to participate in the markets. Meaning volatility is the price you pay to earn the equity risk premium. Or bond yield. In other words, you have to take some risk to get some return. But you have to be smart with how you decide to take that risk, and in turn try to optimize to get the best result, which is what we try to do in the asset management program at GVA.

Case in point we did some trades this week in the models to improve our risk/return ratio on the fixed income side of the equation. Because now that shorter-term bonds are paying better yields, we do not have to go as far out on the yield curve (and hence take more risk) to earn the same yield. This is a result of the Fed raising rates since March. So we are now in a very good position to reduce our risk for the same yield we’ve always targeted in the models. That is a perfect example of how yield and risk are “one with the other” and how we can use this relation to build better portfolios. In finance, this relation is called “The Sherman Ratio” where the higher the ratio the better. So, we applied that concept this week to swap out investment grade bonds for short-term corporates also in the investment grade realm but offering almost the same yield. The key however was reducing our risk because the duration went from an 8 to a 2. That’s a trade we would do all day because it improved our yield-to-risk ratio very nicely. So that’s exactly what we did.

We have been focused on defense and quality all year. But now on top of that with yields where they are, we have an opportunity to reduce risk for the same return. That’s a no brainer and it’s in keeping with our theme that “you can’t have one without the other”. So if that’s the case then we will always strive to optimize that relationship to make it a win-win. Like peanut butter and jelly! You can’t go wrong with that.

Headlines this week were a little lighter than last week’s midterms, inflation and sentiment data. But we continued to see the FTX situation play out. It’s worth nothing though that it does not appear to be spreading into the stock market. Crypto has been a continual mystery to me in terms of how you value it (which has also been the sentiment of Charlie Munger for years) so we have stayed away from it altogether in our allocations. Unfortunately, this will cast a shadow over the crypto industry for quite some time and fallout may be significant but at least it is concentrated to just the crypto universe. It’s also important to think about how there really is no support for the crypto markets; like we have with the Fed in our financial market system.

On the earnings front, Target and Walmart reported very different results and outlooks this week which goes to show the key differences between the two stores. One big difference is how much each relies on groceries. At Walmart, groceries account for 56% of their revenue, while Target only accounts for 20%. Given that groceries are a staple that goes to show why Walmart reported and projected better. Walmart also rests on being the “everyday low price” provider and has gained market share in this environment as households are now beginning to watch their budgets more. It’s an interesting dynamic going on in the consumer space right now with these two big box stores and something to keep an eye on especially as we head into the holiday season.

Uncertainty still looms out there. We know that will never go away but it seems like the market is coming to terms with gaining clarity on a few things as we close out the year here. Like beginning to transition to a possible Fed pivot early next year. Only time will tell but that appears to be where the market is stacking its chips. But we still don’t know that for sure. So for now, let’s keep it simple and focus on asset classes that optimize the risk/return tradeoff. Because “you can’t have one without the other”.

Have a good weekend and enjoy a PB&J sandwich while you’re at it.

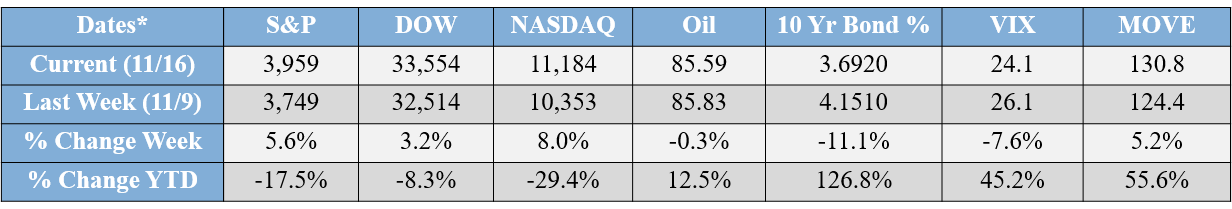

*all data sourced from Yahoo Finance as of the close on the date indicated.

Disclosures

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

- There is no assurance that any products or strategies discussed are suitable for all investors or will yield positive outcomes. Any economic forecasts set forth in this note may not develop as predicted.

- All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Alternative investments may not be suitable for all investors and should be considered as an investment for the risk capital portion of the investor’s portfolio. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

- Securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through Great Valley Advisor Group, a registered investment advisor and separate entity from LPL Financial.

Tracking#: 1-05348222