Summary

- The Fed is likely to raise rates higher and keep them higher for longer than the market currently expects.

- Persistent Fed hawkishness is positive for investors in the long-term, as it helps ensure that inflationary pressures are fully extinguished.

- Why investors are best served to remain fully allocated to equities despite ongoing inflationary pressures and a hawkish Fed.

U.S. stock investors are at it again. Outside of a tax loss harvesting blip at the end of last year, the S&P 500 has been moving steadily higher over the past several months since bottoming last October. Over this time period, the benchmark index posted a more than +20% trough to peak bounce. A primary driver of this recent upside has been the hope, nay expectation, that the hawkish inflation fighting U.S. Federal Reserve would soon be ending their historically aggressive rate hiking cycle and by the end of 2023 will return to their easy policy ways with a fresh round of interest rate cuts. Not only is this likely wishful thinking, it’s not a desirable outcome for those investors wanting to return to a stock market environment of sustainable upside. In reality, we don’t want the Fed to go away anytime soon.

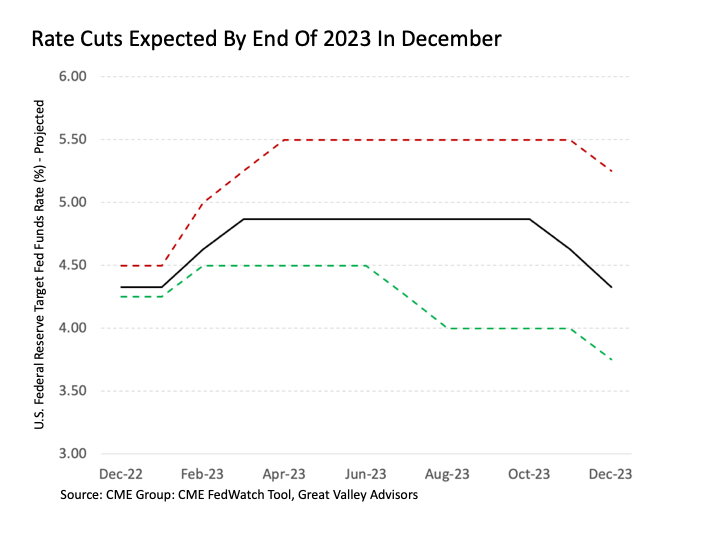

How soon we all forget. It’s amazing how the marketplace seems to never learn. Remember the stock market rebound that started last June (from a bottom that was higher than the October lows) and lasted through most of the summer before peaking in mid-August (at a peak that appear likely to be above the current highs)? This summer lovin’ bounce was driven by dreams that the U.S. Federal Reserve would be back to cutting interest rates by the end of 2022. Turns out, not so much.

Nonetheless, investors have gotten caught up in the same hope today. All Fed Chair Jay Powell apparently needs to do is utter words like “disinflation” and investors get so frothed up that they look past accompanying statements like “very early stages” and “quite a bit of time” and “further rate hikes”.

Here’s the bottom line reality. The Fed is very likely not done raising interest rates. It was hoped as recently as a week or so ago that they might be able to wrap things up with one more quarter point interest rate hike in March.

But last Friday’s jobs report for January that was not nearly as robust as it looked but still quite strong for a Federal Reserve that remains in a credibility saving fight to snuff out inflation measurably raised the probability that further rate hikes will be needed in June and perhaps even July and/or September.

Even with this upward adjustment in interest rate expectations, the market is still betting that the Fed will be back in cutting mode by the end of 2023.

I did not buy into the idea of rate cuts by the end of 2022 last summer, and I do not reside in the rate cuts by the end of 2023 camp today. While I remain a believer in the notion that price is truth and that the current consensus projections in the CME Fed Funds futures market warrant close consideration, it is my expectation that interest rates are likely to higher than the market currently estimates and stay higher for much longer than the market is anticipating well into 2024.

It will be interesting to see how it all plays out, but the following are among the reasons why I believe investors will continue to be disappointed in a Fed that remains more hawkish than anticipated.

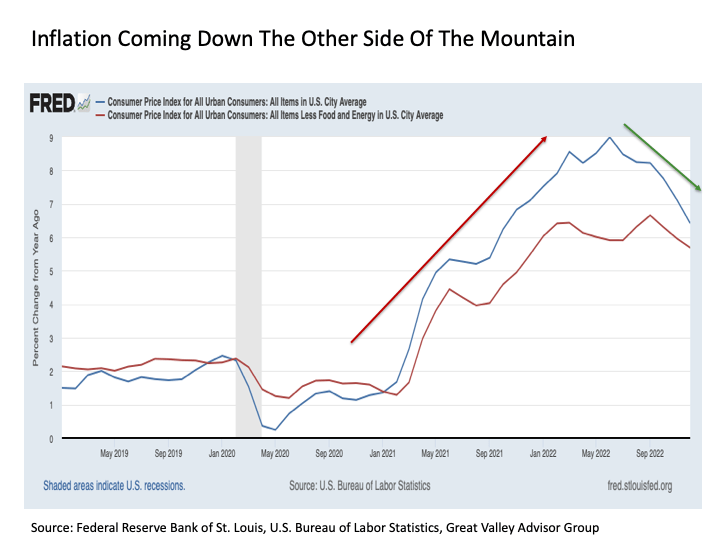

Hard now just to make ends meet. Yes, disinflation is happening. We didn’t need the Federal Reserve to tell us, as we have all been able to see for months that pricing pressures have been falling. The headline inflation rate peaked last July, and the core inflation rate topped out in September. Since that time, inflation has been coming down. Awesome – I’m glad we’re getting something for the more than four percentage points of interest rate hikes that have been jammed down the throat of the U.S. economy over the past year (ladleful of sugar anyone?).

Looking forward, the market has little doubt that the Fed will ultimately win the current inflation war, as the 5-year breakeven inflation rate is pressing its way back toward 2%.

But here’s the thing. Inflation is still in a blistering hot range near 6.5% on the headline and over 5.5% on core excluding food and energy. Put simply, we still have a loooooong way to go before inflation is back down to levels that we would associated with the words “price stability”. I get that the market is forward looking, but to quote our Fed Chair, the path ahead is not likely to be “smooth” and instead is bound to be “bumpy”, which is a gentle way of saying that s&#* could get real before we get back to where we ultimately want to be on inflation.

But here’s another thing. After the Fed wins the inflation battle assuming the 5-year breakeven rate is correct, it’s not as though the Fed can simply turn tail and start cutting interest rates. Even if the U.S. economy is mired in recession as the inflation rate fully returns to earth, the Fed will likely need to keep interest rates much higher than they might otherwise want. Why? Because the Fed has a couple of decades of inflationary/stagflationary history from the 1960s to 1980s where they made the same mistake over and over again of cutting interest rates too early in the midst of a recession before inflationary pressures were fully extinguished, thus leading to a renewed spike in inflation that was repeatedly worse than the last episode. The Fed is already smarting from a credibility standpoint by waiting far too long to end quantitative easing and start raising interest rates less than a year ago in March 2022, so I would presume the last thing they want to do is “mission accomplished” the inflation fight by declaring victory too early and ignoring the well learned lessons of inflation fighting past.

I need more time just to make things right. So what does needing the Fed to stay hawkish for longer mean for the U.S. stock market today?

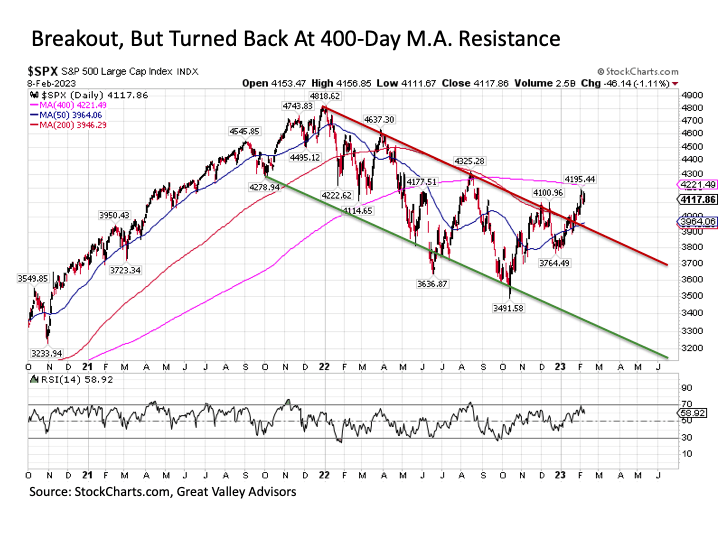

The U.S. stock market has indeed had a fantastic run in recent months that has culminated with an upside breakout above the downward sloping trading channel that has been in place since the start of the bear market back in January 2022. This recent price movement alone highlights why investors are well served to maintain a dedicated equity allocation and to eschew shorting the stock market. And after all, this macro analyst may be dead wrong in his prognostications and the S&P 500 may continue to scream higher in 2023.

With that said, U.S. stocks may have arrived at a juncture where it is set to reverse back to the downside at least in the near-term. The S&P 500 reached a key resistance level in its ultra long-term 400-day moving average coming out of the latest Fed meeting, and it has since been turned back to the downside as the reality increasingly seeps into investor minds that the Fed probably has quite a bit more work to do for quite a bit longer than previously anticipated.

It was frequently and rightly said over the period from 2009 to 2021 when stocks seemed to endlessly rise beyond all reason, when good news was good news and bad news was good news for stocks, “don’t fight the Fed”. If we are best not to fight the Fed when they are easing, why should we ignore this same mantra when the Fed is tightening as they are today? Particularly when a rising stock market is inflationary and flies directly in the face of what the Fed is currently trying to achieve.

So don’t go away. Does the high probability for a renewed move to the downside in the S&P 500 bode ill for U.S. stock investors? Absolutely not. Not only does a disciplined asset allocation program require a dedicated allocation to stocks, but this stock allocation should already be positioned for the current and expected economic and policy reality that we continue to navigate.

As we know, such an environment does not favor the past winners on the growth side of the market in the information technology, communication services and consumer discretionary sectors that flew so high for so long in the sluggish economic growth, zero interest rate environment of yore.

Instead, it favors more value oriented defensive allocations that can either directly benefit from higher inflation such as energy and/or have wider economic moats and strong pricing power in the consumer staples and health care sectors.

Looking forward, it is also eventually bound to uplift more interest rate and economically sensitive sectors such as financials at first and then transports if and when we begin traversing the economic recession that likely still lies ahead in 2023. Even if the recession never comes, these market segments still have a history of performing particularly well as economic activity begins to accelerate.

And lest we forget the geopolitical environment, that continues to favor military and defense related allocations for unsettlingly apparent reasons.

So while we don’t want the Fed to go away from more hawkish monetary policy until they fully finish the inflation fight, we too as investors do not want to go away from a marketplace that remains filled with attractive stock investment opportunities even if the headline S&P 500 is struggling along the way.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. Great Valley Advisor Group and Stonebridge Wealth Management are separate entities.

This is not intended to be used as tax or legal advice. Please consult a tax or legal professional for specific information and advice. Third party posts found on this profile do not reflect the views of GVA and have not been reviewed by GVA as to accuracy or completeness.