Boy: “Hay una tormenta en camino.”

Sarah Connor: “What did he just say?”

Gas Station Attendant: “He said there’s a storm coming in.”

Sarah Connor: “I know.”

–The Terminator, 1984

A different storm. Yes, Artificial Intelligence is increasingly taking over the world. And while I’m not sure that NVIDIA will have perfected the chips in the next four years to enable Skynet to send an Arnold Schwarzenegger automaton back in time to 1984, it is hard to ignore that 2029 is right around the corner. With that said and despite the fact I’m working on getting a voice that sounds like HAL 9000 from 2001: A Space Odyssey for my talking ChatGPT (if only my name was Dave…), the threat of AI is not the storm I’m writing about as we head into the fall of 2025. Instead, the impending storm is called inflation.

“Perhaps I’m just projecting my own concern about it. I know I’ve never completely freed myself of the suspicion that there are some extremely odd things about this mission.”

–HAL 9000, 2001: A Space Odyssey, 1968

Just what do you think you’re doing, Jay? On March 17, 2022, the US Federal Reserve led by its Federal Open Market Committee (FOMC) embarked on its most aggressive monetary tightening campaign in nearly two generations. Having kept short-term interest rates pinned effectively near zero for well over a decade since the financial crisis and through COVID, the FOMC raised interest rates by over 5% through July 27, 2023 to diffuse the most significant outbreak of inflation since the period of time from the late 1960s to the early 1980s. Despite waiting way too long under “transitory” delusions to finally start tightening monetary policy in early 2022, the Fed ultimately achieved its goals of bringing inflation back down into a more sustainable 2% to 3% range. All good so far.

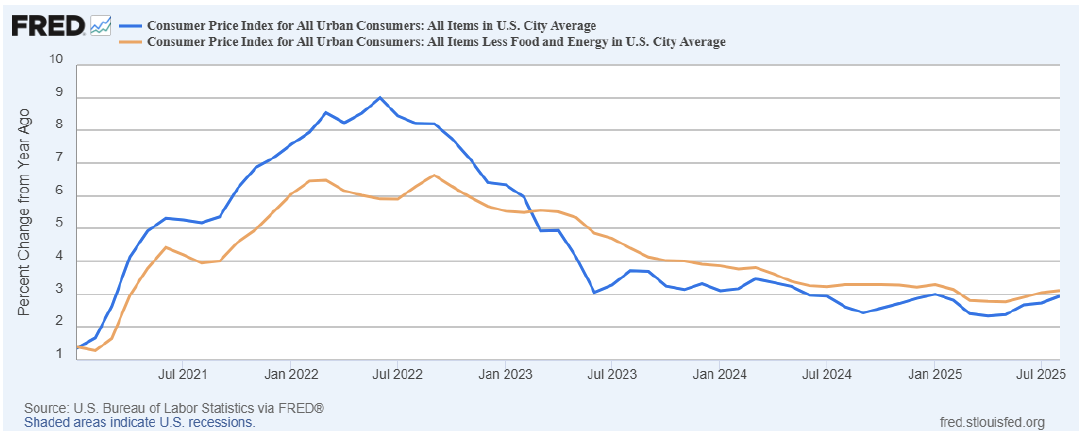

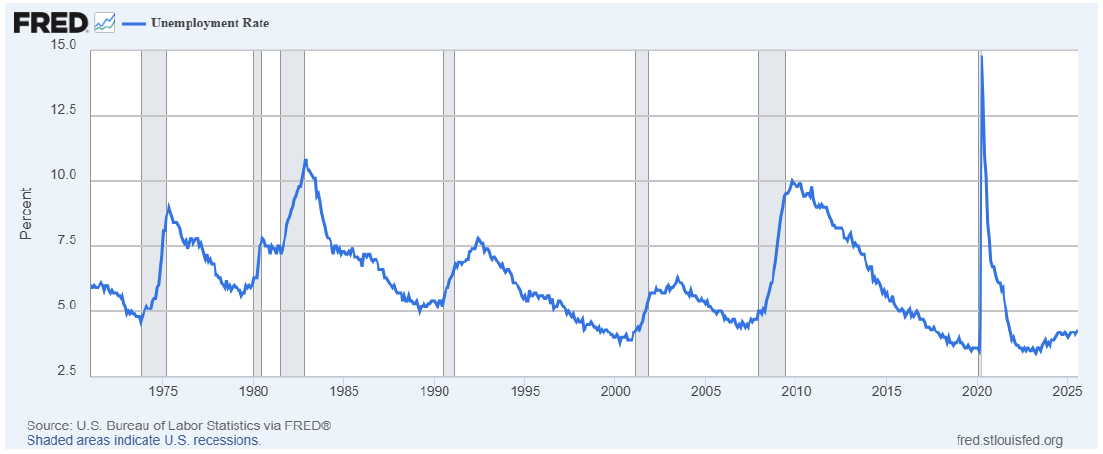

But let’s fast forward to this time last year in September 2024. Inflation appears largely under control with headline CPI back in the 2%s and core CPI just above 3%, both trending lower. U.S. economic output was still growing at a steady clip at the time, but the unemployment rate had ticked up somewhat from a low of 3.4% in April 2023 to 4.1% in September 2024 (never mind that 3.4% was tied for the lowest unemployment reading on record since 1953 and 4.1% still represented the lowest unemployment rate in the U.S. since 1970 save a handful of months at the end of the tech bubble), so the Fed decided it needed to “get to work” with a 50 basis point rate cut in September 2024 followed by two more quarter point cuts in November and December 2024. Summary: 100 basis points in four months just because, you know, why not. This was and has been the first major cumulonimbus cloud in the impending storm – this increasingly engrained notion that the U.S. Federal Reserve should be cutting interest rates not because it needs to, but simply because they can. Don’t let those interest rate cuts burn a hole in your Federal Reserve wallet!

I was not at all a fan of Fed rate cuts at the time, and I thought leading with 50 basis points when the market was largely expecting 25 basis points up until the final days before the September 2024 FOMC meeting was, how can I say it as politely as HAL and not as abrasively as when The Terminator visited the police station searching for Sarah Connor, misguided. Apparently, I was not alone, as the bond market also hated it, as the 10-Year U.S. Treasury yield proceeded to rise from a low of 3.6% literally as the Fed was meeting in mid-September 2024 to over 4.8% by early January 2025 around the time when the Fed finally stood down following 100 basis points of cuts.

What has the bond market done in the months since mid-January? Yields have steadily come back down.

That of course, brings us to today. On September 18, the U.S. Federal Reserve resumed their interest rate cutting campaign, this time lowering interest rates by another 25 basis points.

“But why!?!“, this Chief Market Strategist is left to strenuously restrain himself from exclaiming.

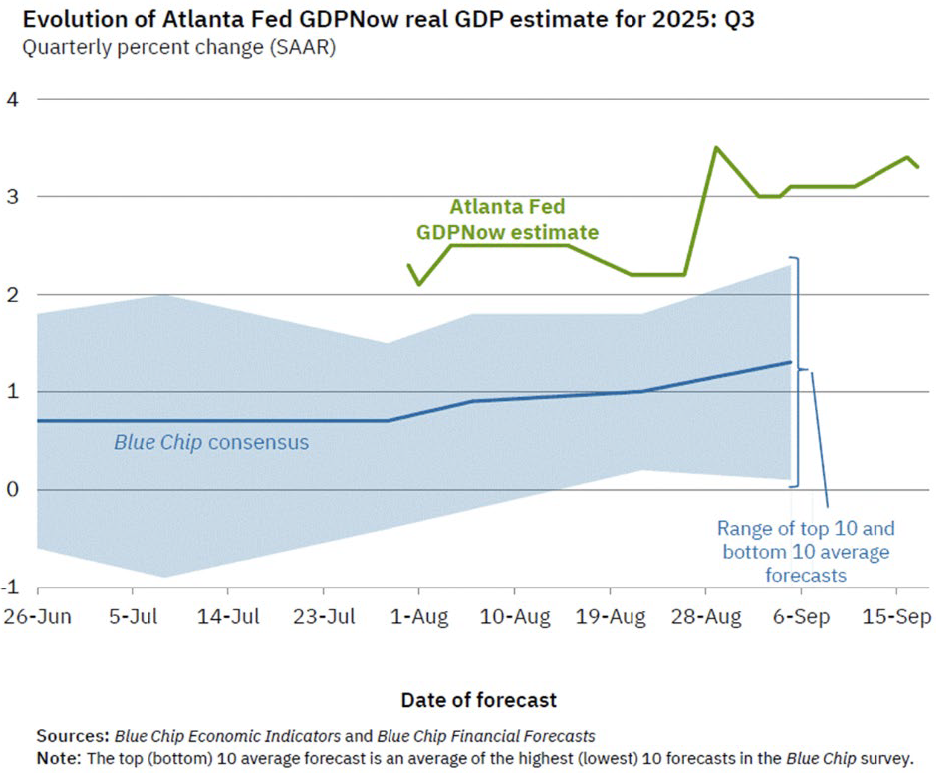

Let’s start with the economy. Despite worries about the recession in the U.S. that was supposed to arrive in 2022, then 2023, then 2024, and now 2025 but never, ever actually shows up, the U.S. economy remains strong. Consider the latest estimates for Real GDP growth for 2025 Q3. In a pattern we have seen repeat itself over and over and over again over the last several years, the actual data is signaling a much stronger economy than what the handwringing “Blue Chip” economist consensus is predicting how the economy will perform. For while the “experts” were projecting U.S. Real GDP growth will increase by less than 1% this quarter, the data signals that it is on pace to exceed 3% on a quarterly percent change basis. This is not only growth, but strong growth that continues to persist beyond expectations.

Are their signs of weakness on the margins? Absolutely, but there’s always signs of weakness on the margins. A “wall of worry” isn’t just there; it has to be constantly built over and over again. It’s always there. Will we eventually get an economic recession at some point? Absolutely, but it doesn’t appear it’s going to happen right now or anytime soon for that matter.

Let’s continue forward. What about the unemployment rate? Still at 4.3% as of August 2025 (see earlier chart), which is barely above the 4.1% rate this time last year and still represents the lowest unemployment rate we have seen in this country since 1970 save a few peak months over the last 55 years. If AI is coming to take all of our jobs away along with Sarah Connor, it apparently has not arrived just yet.

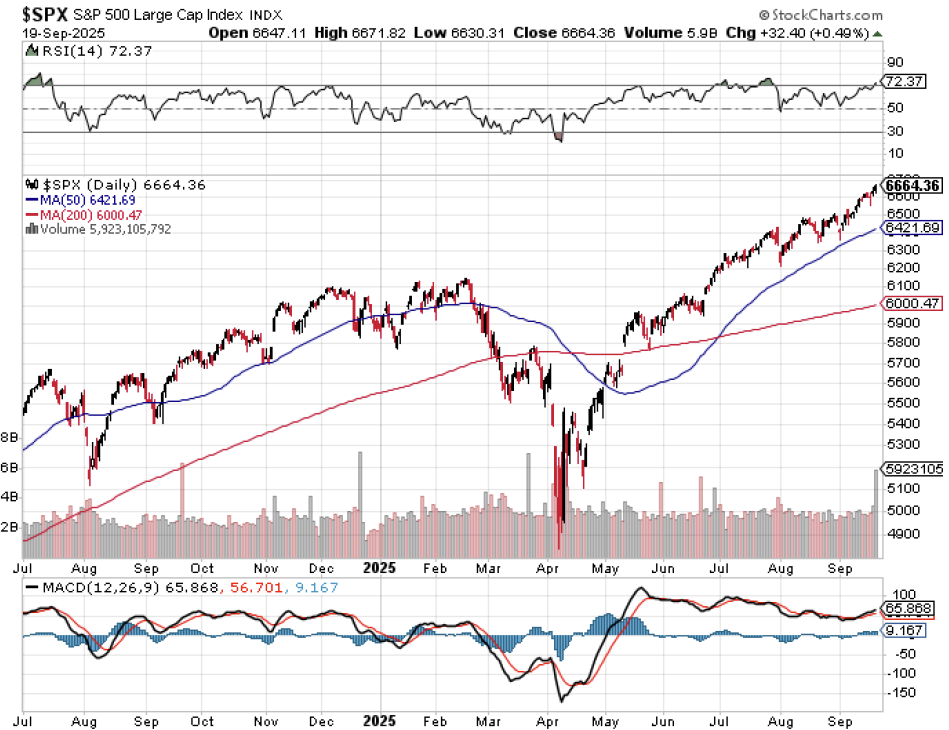

Strong economy, low unemployment rate, what about the U.S. stock market – the Lennie Small to the U.S. bond market’s George Milton (mixing my metaphors, I know – classic American literature is not the theme of this article – back to our regularly scheduled “sci fi” references, or will it ultimately be “sci fact”? Insert pensive thought emoji)? After all, I learned when growing up in my investment career that the U.S. stock market moves nine months ahead of the U.S. economy on average. Where is the U.S. stock market today? Trading overbought at fresh new all-time highs (insert another pensive thought emoji).

Preach HAL. There are some extremely odd things about this Fed rate cutting mission.

“I’ll be back”

–The Terminator, 1984

Desperately seeking Sarah Connor. So what could possibly go wrong here? Isn’t this awesome from an investment perspective. The stock market is already performing balls to the wall, and now it’s getting even more power in the form of rate cuts from the U.S. Federal Reserve. How much more? The CME Fed Funds futures are pricing in a more than 90% chance of another quarter point cut in October and a more than 80% chance of a third quarter point cut in December. And the key date to watch next year is May 15, 2026 when a new Fed Chair will grace the halls of the renovated Marriner Eccles Building. And from where I am sitting today, I do not see Jay Powell’s successor prioritizing hiking interest rates much less keeping interest rates level upon assuming the job, but only time will tell.

Here’s what can and increasingly likely will go wrong in bringing the next storm to the economy and financial markets.

Straight up, the Fed should not be cutting interest rates right now in the view of this Chief Market Strategist. If someone landed here from Mars or any Macroeconomics 101 class having just finished studying Chapter 15 in their textbooks entitled Monetary Policy, when presented on an exam with a scenario of persistently strong GDP growth and low unemployment what is the proper monetary policy response, the correct answer would not be to become more accommodative with policy. At best, a neutral stance would be justified with an eye toward potentially becoming more restrictive. Quick aside – the same question would apply when studying Chapter 12 – Fiscal Policy in this same class. The correct answer would certainly not be to lower taxes and/or increase spending (“and” applies today). Instead, consideration at minimum should be given to raising taxes and cutting spending under today’s circumstances. Raise taxes and cut spending. Funny (insert audible snicker), as that just simply isn’t going to happen on any side of the political aisle today until politicians are standing up to their knees in the fire.

Of course, one key variable that has not been mentioned in the body of this article until now is also critical in determining the current and future path of interest rates, and that of course is inflation. The economy and financial markets remain sufficiently strong that if anything we are at risk of running hot even with a neutral monetary policy stance. But instead of contemplating whether we should be tightening monetary policy to help stave off any accumulating pricing pressures in the months ahead, the Fed is instead moving to loosen monetary policy. Yikes!

For the record, I would not advocate for the Fed to raise interest rates in the current market environment. Instead, I’m in the “if it ain’t broke, don’t fix it” camp that if GDP is growing at a +3% clip with unemployment at 4.3%, corporate earnings growing at a double-digit rate, and the U.S. stock market at all-time highs, just leave things alone instead of throwing gasoline on the fire that might reignite an inflation problem we’ve been still working to eliminate the last few years. Now we’re looking at a situation where the Fed may eventually need to raise interest rates to correct for the potentially misguided lowering of interest rates today. And whether the Fed will have the gumption to follow through in raising interest rates if needed six, twelve, eighteen months from now remains to be seen.

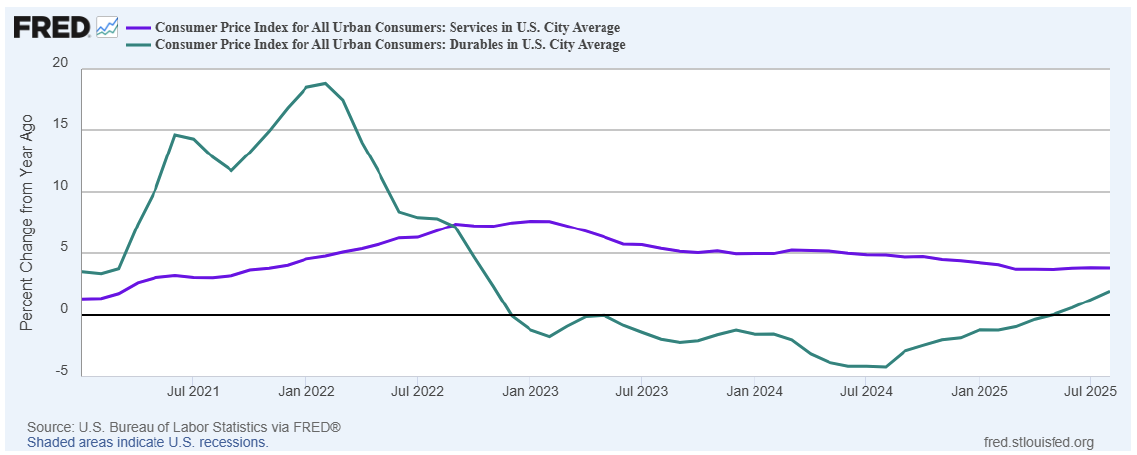

All of this points to an inflation storm that is increasingly building on the horizon. In fact, one can already feel the first heavy drops of pricing pressure rain in the data today. For example, after bottoming in the spring month-over-month headline and core CPI has been steadily rising at a measurable rate, with core CPI now back above 3% on an annualized basis and headline soon to follow. And looking further into a chart that scares the bejesus out of me from an inflation perspective (see below), we see that while services inflation (purple line) never really fully cooled off from the 2022 outbreak still hovering near 4% annualized, goods inflation (green line) that was the primary culprit for the 2022 inflation outbreak and had been until recently been mired in deflation and the primary driver in bringing pricing pressures back down is now once again screaming to the upside at +2% year over year and rising fast.

Let’s bottom line it. The Fed is now cutting interest rates at a time when inflationary pressures are starting to burst back onto the scene. If anything, they should be starting to think about raising interest rates, but the exact opposite is now happening. It promises to be an increasingly interesting rest of 2025 into 2026 for financial markets and policy makers on this front.

Bottom line. Remember. Although it got messy along the way, Skynet and The Terminator did not defeat Kyle Reese and Sarah Connor. And while HAL got all medieval on Frank Poole, some pretty transformational events took place after Dave Bowman got HAL singing “Daisy” (we’d probably need a film study appendix article to figure out how we wedge the ending from that one into the discussion).

Also remember, while the S&P 500 and the Bloomberg Aggregate Bond Index dropped by more than -22% and -14% respectively during the 2022 inflation induced bear market – that’s a wicked storm for the 60/40 crowd – sectors within the stock market like energy soared by as much as +50% along with others such as utilities and consumer staples that were both solidly positive for much of the downturn. At the same time, those that steered to the short duration side of the bond market were rewarded with a steadily increasing coupon to clip with minimal price volatility.

An inflation storm may be coming to financial markets, but I’ve always loved sitting on the porch listening to the rumbles of thunder as the rains roll in. Next time around should be no different.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

LPL Compliance Tracking #: 800074